In today’s post, we’ll discuss the impact of incorrectly classifying Interim Accounts in the financial statements and how it can affect our reporting.

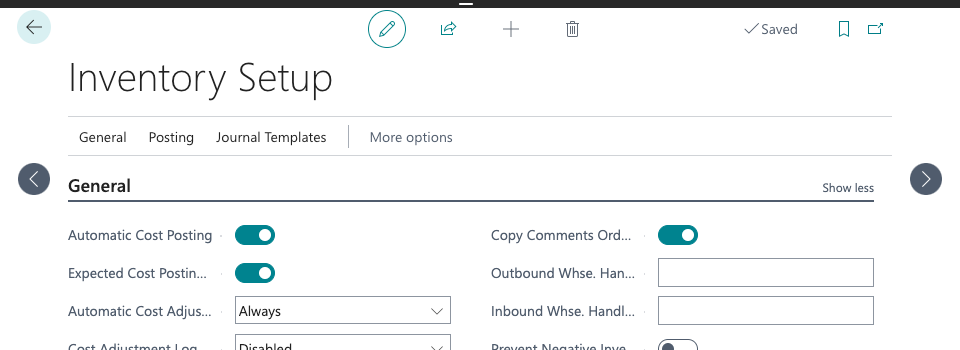

As you know, when “Expected Cost Posting” is enabled, the system requires additional G/L accounts for “COGS (Interim)” and “Invt. Accrual Acc. (Interim)”.

Often, when new customers migrate to Business Central from accounting software or system without inventory management, will not have these G/L accounts set up and may hesitate to create new ones. Instead, they may want to use the existing COGS and Purchase expense account.

Consultants should emphasize the importance of creating new G/L accounts in the correct financial statement classification to avoid poor accounting practices and ensure accurate financial reporting.

Correct Financial Statement Classification

Both “COGS (Interim)” and “Invt. Accrual Acc. (Interim)” should be created under the “Balance Sheet” to accurately reflect their nature as temporary accounts that track inventory-related costs and accruals.

Placing these accounts under “Income” would misclassify them, leading to incorrect financial reporting.

It is essential to maintain proper classification to ensure accurate financial statements, as these interim accounts represent amounts that are not yet recognized as expenses or revenue until the inventory is sold or the accrual is reversed.

| Classification for Interim GL | Classification |

|---|---|

| COGS (Interim) | Balance Sheet / Asset |

| Invt. Accrual Acc. (Interim) | Balance Sheet/ Liabilities |

Financial Impact when closing Financial Year

One of the biggest impacts from the wrong classification is when closing the Financial Year.

Below is a table illustrating (using Sales/COGS as example) the impact of setting up the accounts in the wrong classification when it comes to Financial Year closing.

| “Income” GL | “Balance Sheet” GL | |

|---|---|---|

| Shipment | (Debit) Income-COGS: 1,000 (Credit) Inventory: -1,000 | (Debit) Balance Sheet-COGS: 1,000 (Credit) Inventory: -1,000 |

| FY Closing | (Debit) Retained Earning: 1,000 (Credit) Income-COGS: -1,000 | NA |

| Net Impact | (Debit) Retained Earning: 1,000 (Credit) Inventory: -1,000 | (Debit) Balance Sheet-COGS: 1,000 (Credit) Inventory: -1,000 |

As illustrated, using “Income” G/L accounts for interim accounts can result in these amounts being mistakenly recognized as income. When the financial year closes, this misclassification would cause them to be transferred to Retained Earnings as losses, ultimately distorting the financial statements and leading to inaccurate reporting.