Today’s topic focus on the essential steps for accurately migrating open foreign invoices to Business Central.

By following the best practice, you can ensure that Accounts Receivable and Accounts Payable balances are precisely maintained and accurately reflected when these invoices are eventually closed within the system.

Common Mistake

A mistake often made by end-users and consultants during migration is using the revalued amount of open foreign invoices as of the opening date and not the original amount.

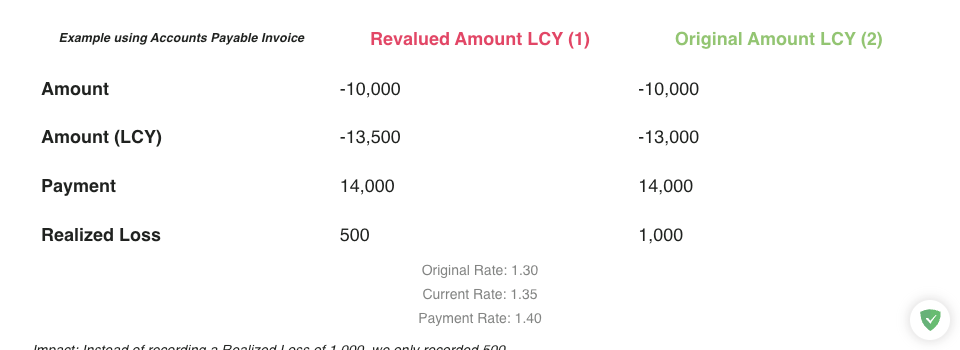

The illustration below highlights the key impact between migrating open foreign invoices using the Revalued Amount LCY (1) versus the Original Amount LCY (2).

| Example using Accounts Payable Invoice | Revalued Amount LCY (1) | Original Amount LCY (2) |

|---|---|---|

| Amount | -10,000 | -10,000 |

| Amount (LCY) | -13,500 | -13,000 |

| Payment | 14,000 | 14,000 |

| Realized Loss | 500 | 1,000 |

Current Rate: 1.35

Payment Rate: 1.40

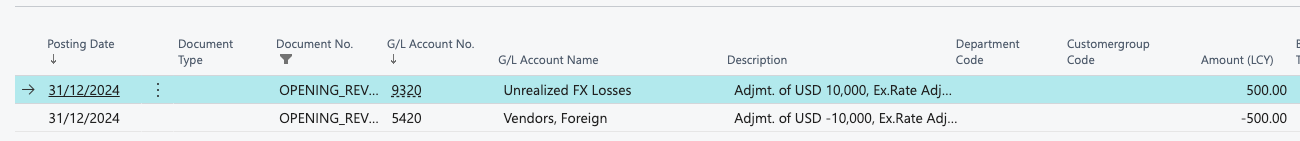

Impact: Instead of recording a Realized Loss of 1,000, we only recorded 500.

As you can see, using the wrong method will impacts the realized gain/loss, leading to inaccuracy in the financial statements.

Now, imagine the scale of discrepancies this could cause with higher transaction volumes and larger amounts.

How to Migrate Correctly?

Here, I will outline the correct steps to migrate open foreign invoices to Business Central, ensuring accuracy in our Accounts Receivable and Accounts Payable records.

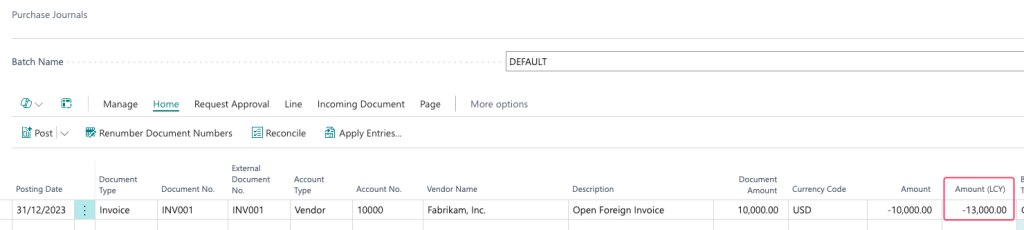

1. Migrate using Original Amount LCY (2)

We will ignore the Revalued Amount LCY (1) and use the posted Original Amount LCY (2).

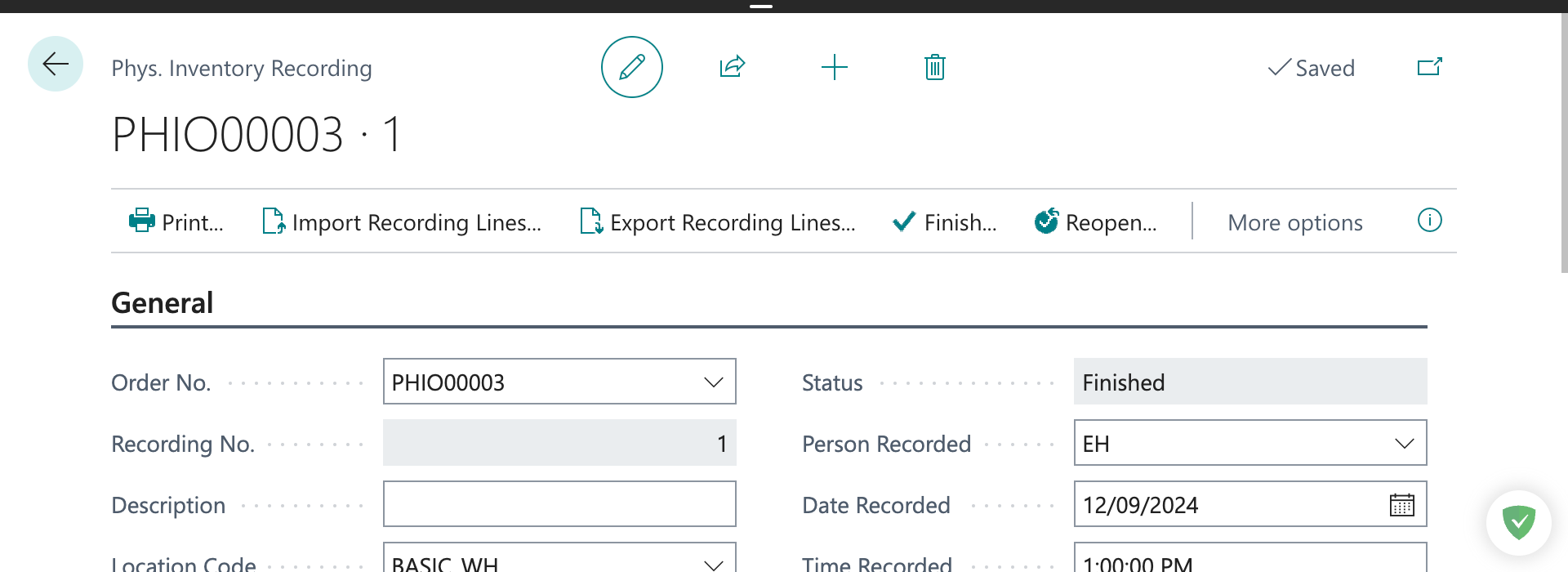

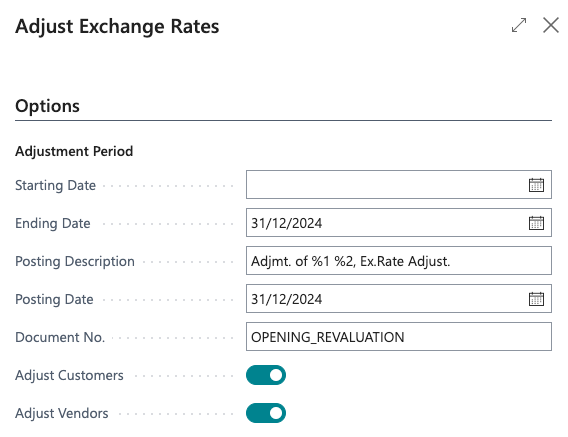

2. Perform “Adjust Exchange Rates”

We will run ‘Adjust Exchange Rates’ function to revalue the open foreign invoices to our opening date rate.

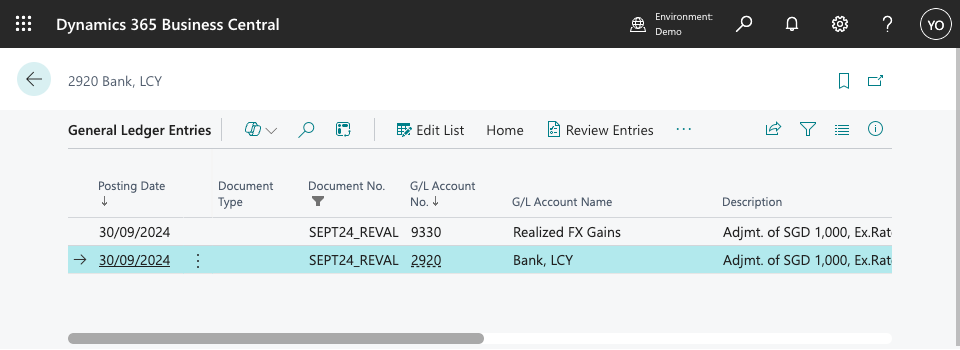

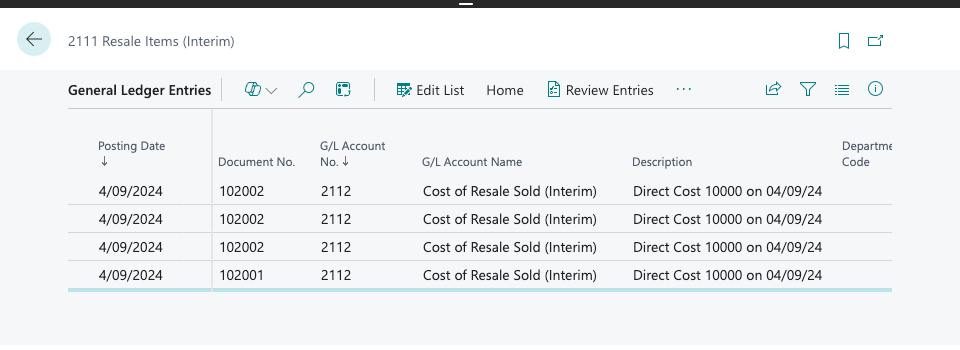

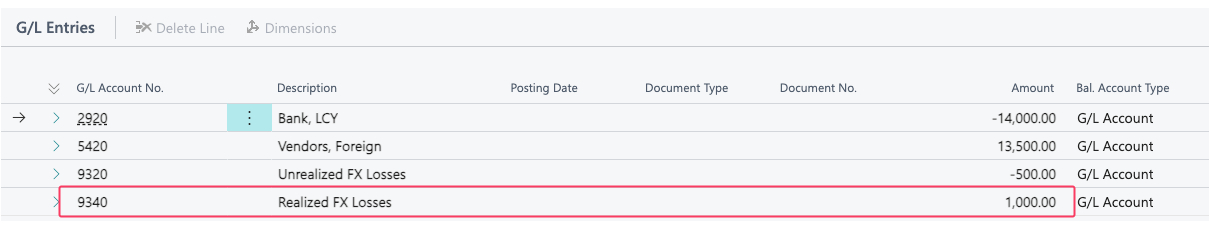

3. Reverse “Adjust Exchange Rates” Entries

Now, we will need to reverse the general ledger entries generated from “Adjust Exchange Rates”.

The reason for this reversal is not as complicated.

- The purpose is to revalue our subledgers (Vendor Ledger Entries / Customer Ledger Entries) to the opening rate.

- Entries created on “General Ledger Entries” are already part of our Trial Balance opening value, we will not want to double count them.

4. Result

With the right method, we have now correctly posted the amount to our Realized Gain/Loss account.